|

1905 movie network feature Just into July, the sudden death of Italian composer Ennio Morricone caused fans around the world to mourn.

The most famous and prolific film score master of the 20th century, he has composed scores for more than 500 films and television over a period of more than 50 years.

Including "Once Upon a Time in America", "Red Dead Redemption" and other films, the fields involved include: classical, jazz, pop, rock, electronic, avant-garde music, Italian folk music, etc…

|

His works not only accompany generations of young people, with a full, free, and light mood, through every dull day, but also provide a source of inspiration for many film masters. His career is half a film history, and many filmmakers still use soundtracks to continue his spirit.

For the average audience, the name Ennio Morricone may sound a bit unfamiliar, but you must have heard of his soundtrack. Because of his production, the recognition of the work, and the citation rate are too high.

"Once Upon a Time in the West" alone has been quoted in five films, including Bruce Lee’s "Dragon Crossing the River" and Johnny Depp’s "Pirates of the Caribbean 3". There is also the Deborah-themed score of "Once Upon a Time in America," most familiar to Chinese fans, which was used by Wong Kar-wai at the end.

In the most colorful part of "The Grandmaster", Gong Er confided in Ip Man. Wong Kar-wai chose "La Donna Romantica", an episode written by Morricone for the Italian film "Teach Me How to Love You" in 1966.

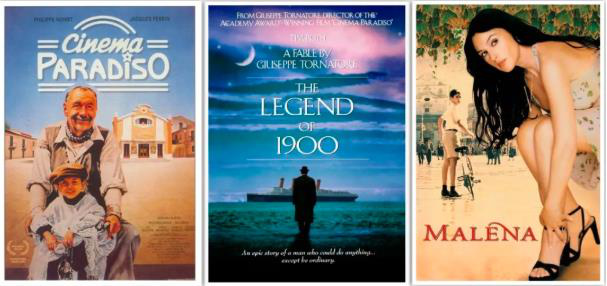

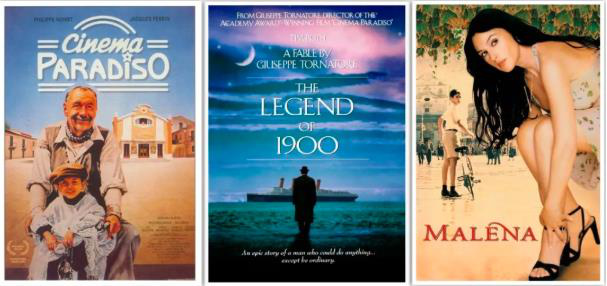

Even in restaurants, cafes, radio stations, advertisements, and evening shows, we often hear his soundtracks, such as Giuseppe Tonadore’s "Time and Space Series" ("Cinema Paradise" and "Pianist at Sea").

"Once Upon a Time" by Sergio Leone (Once Upon a Time in the West, Once Upon a Time in Revolution, Once Upon a Time in America).

And "Redemption Series" ("Red Dead Redemption", "Twilight Redemption", "Golden Three Redemption").

These three series are the most important masterpieces of Morricone’s soundtrack career, and they have also provided a generation of Chinese audiences with the cognitive enlightenment of European films.

He was inspired by his father, a jazz trumpeter, and his mother, who gave him free will. Morricone, who grew up in an immersive environment, completed a four-year course at the conservatory in two years.

|

After working on orchestral and chamber music for a while, I first tried to score a film for elementary school alumnus Sergio Leone’s "Red Dead Redemption," which ushered in a 20-year collaboration between the two and ushered in a whole new era of Westerns.

|

Before the "Escort Series", Westerns followed the classical style represented by American films such as "Flying Off Mountain", "Red River Valley" and "Raider of the Wild". Italian directors such as Leone have successfully turned "macaroni" -style Westerns into a popular classic through low-budget Westerns such as the "Escort Series".

The so-called "macaroni" Western is a cheap B-rated Western created by Italian directors. Low cost and low risk, giving creators more freedom.

In "Red Dead Redemption", Morricone ditched the exaggerated and expensive orchestral music of traditional film soundtracks and instead created his own style, using non-traditional instruments such as electric guitars, wind instruments, Mexican horns, and mufflers, mixed with whistles, guns, whips, finger snaps, and other environmental sound effects, not only creating a magnificent, desolate, and playful atmosphere, but also pioneering the narrative elements in music.

|

In the Western film collaborated by two old friends, we can experience a unique Italian romance from the story to the music: with wildness and innocence.

This romance not only moved audiences accustomed to classical school, but also moved many small movie fans, and led them to enter the film industry. For example, Quentin Tarantino, the "Golden Three Redemptions" in the "Redemption" series has always been the first in his personal list.

|

It is said that Morricone had almost refused to score Quentin’s music because of his poor aesthetic, and later the two collaborated again in "Eight Villains". Morricone won the 88th Academy Award for Best Original Score for the film, ending his 51-year Oscar career.

|

Morricone’s relationship with the Oscars, like his attitude towards his homeland and Hollywood, has always been reserved.

He has won five Oscar nominations for Best Original Score for "The Church", "Iron Faces", "The World of Pride" and "The Beautiful Legend of Sicily", but he returned empty-handed.

|

He refused the free apartment offered to him by Hollywood, and even refused to learn English. Even when he took the stage to accept the award, he "debuted" with the star Clint Eastwood during the "escort" period to help translate.

|

He loves his hometown so much that he would rather live in Rome forever. We can feel Lao Mo’s nostalgia for his hometown through music in Giuseppe Tonadore’s "Time and Space Series".

In "Beautiful Legend of Sicily", a strong Italian style played on a guitar single string.

|

In "The Pianist at Sea", 1900 listens to the southern Italian folk dance "Tarantella".

|

There is also the tear-jerking "film montage" in "Cinema Paradise", which also uses the simplest music to weave the memory structure of the hometown and childhood.

|

Morricone’s music can turn movies into epics, forming their own unique scenery in the long river of European movies. Especially the films he collaborated with "Fa Xiao" Leone, from technological innovation to connotation excavation, have been admired and learned by future generations.

|

Mr. Leone spent 16 years completing "Once Upon a Time," a series that Chinese audiences are most familiar with, after more than four hours, and which is still regarded as one of the 10 must-see films for men.

|

"Once Upon a Time in America" also had a profound impact on many Hong Kong directors, such as Wong Kar-wai and John Woo;

|

Probably because most fans put "Once Upon a Time in America" in the top position, the other two "Once Upon a Time" series received relatively less attention, but it did not prevent them from becoming the favorite of many people.

|

For example, "Revolutionary Past", which won the David Award for Best Director in Italy, combines humor, romance, and western styles, making it a new exploration of the western genre by Leone;

There is also "Once Upon a Time in the West", whose soundtrack is as classic as "Once Upon a Time in America", and it can better show the yearning for freedom in the master’s heart.

|

It is said that the music for "Once Upon a Time in the West" and "Once Upon a Time in America" was prepared before filming began. Morricone created the music according to the ideas of Leone, who played Morricone’s music clips on the set during filming, and the actors followed the rhythm.

|

This characteristic, which is similar to dance and opera, also gives "Once Upon a Time in the West" an extremely vivid look and feel.

|

"Once Upon a Time in the West" also has a name called "Wild Sand One Hundred Thousand Miles", and the film gives people the feeling of the west wind howling and the sand from the beginning.

This artistic conception is all-encompassing, whether it is a later American Western or a Chinese martial arts film, it can be perfectly matched.

|

The charm of this artistic conception lies in Morricone’s melodious and magnificent music, which makes the audience believe in the strong sense of conviction of the protagonists.

|

Some people say that the music of "Once Upon a Time in America" expresses the soul-stirring of life, while "Once Upon a Time in the West" expresses the farewell of people and their hometown.

In the music, you can feel the dreams and sacrifices of the pioneers, as well as the deep and rugged Western spirit. To some extent, the immortality of the soundtrack of "Once Upon a Time in the West" goes beyond the film itself.

In particular, the theme song "Once Upon a Time in the West" of the same name is a masterpiece of world film music.

This song, which was born 52 years ago, even though it has been quoted and paid tribute to by so many movies, still has a strong sense of time and space, and a common nostalgia with all mankind. It seems that the golden age of reclamation of the wasteland of that generation was carried away by the sand.

It is worthy of being called a great elegiac in the history of the American West.

|

As the greatest Western in film history, "Once Upon a Time in the West" tells the story of a mysterious man who arrives in a small western town and is embroiled in a land battle between a widow and a railroad tycoon.

The most interesting character in the film is Henry Fonda, the first-ever villain, who plays a cold-faced killer.

|

On the evening of July 12th at 22:10, the movie channel will broadcast "Once Upon a Time in the West", which has an important position in the history of film soundtracks, together with Morricone’s timeless melody, back to that golden age. At the same time, "A Good Film Date" will also broadcast "The Pianist at Sea" again in the near future.